Reinsurance for Smarter Risk Management

We specialize in addressing underwriting and capital management challenges, showcasing a deep understanding of the complexities involved in managing risk and financial resources within the insurance industry. Our comprehensive range of services supports insurance companies, encompassing risk analysis, designing and placing reinsurance programs, providing claims support, developing alternative risk strategies, and offering various risk management consulting services. Through services like reinsurance program design and alternative risk strategies, we create tailored solutions, underscoring our commitment to helping clients achieve their specific objectives by addressing their unique challenges and goals.

Reinsurance for Smarter Risk Management

We specialize in addressing underwriting and capital management challenges, showcasing a deep understanding of the complexities involved in managing risk and financial resources within the insurance industry. Our comprehensive range of services supports insurance companies, encompassing risk analysis, designing and placing reinsurance programs, providing claims support, developing alternative risk strategies, and offering various risk management consulting services. Through services like reinsurance program design and alternative risk strategies, we create tailored solutions, underscoring our commitment to helping clients achieve their specific objectives by addressing their unique challenges and goals.

What We Offer

1. Reinsurance Services

Our reinsurance services are based on local and international best practices that aim to forge long- term relationships with our clients and partners. The services are powered by highly qualified staff and the application of the latest technology in operations, risk analysis, data analytics, and actuarial models.

2. Reinsurance Solutions

We offer a range of reinsurance broking solutions to equip our clients with a competitive edge that goes beyond the best pricing in the reinsurance market. Leveraging on our expertise, market experience and relationships, we craft solutions that suit your business portfolio mix and negotiate for terms are with well-rated markets. The products are anchored on a 360-risk solution that aims at growth in premiums, balanced retention and ceding of risks, improved solvency margins, and, in turn, achieve the best credit rating for a cedant.

3. Data And Modelling

Actuarial science and data analytics are the twin lenses through which we can gain clarity on the uncertainties of the past and present, to empower us to shape a more certain and enlightened future. At Acentria, through the combination of data science, information technology and actuarial work we are able to give enhanced outlook with data which helps Insurers and reinsurance better informed in decision making and risk mastery.

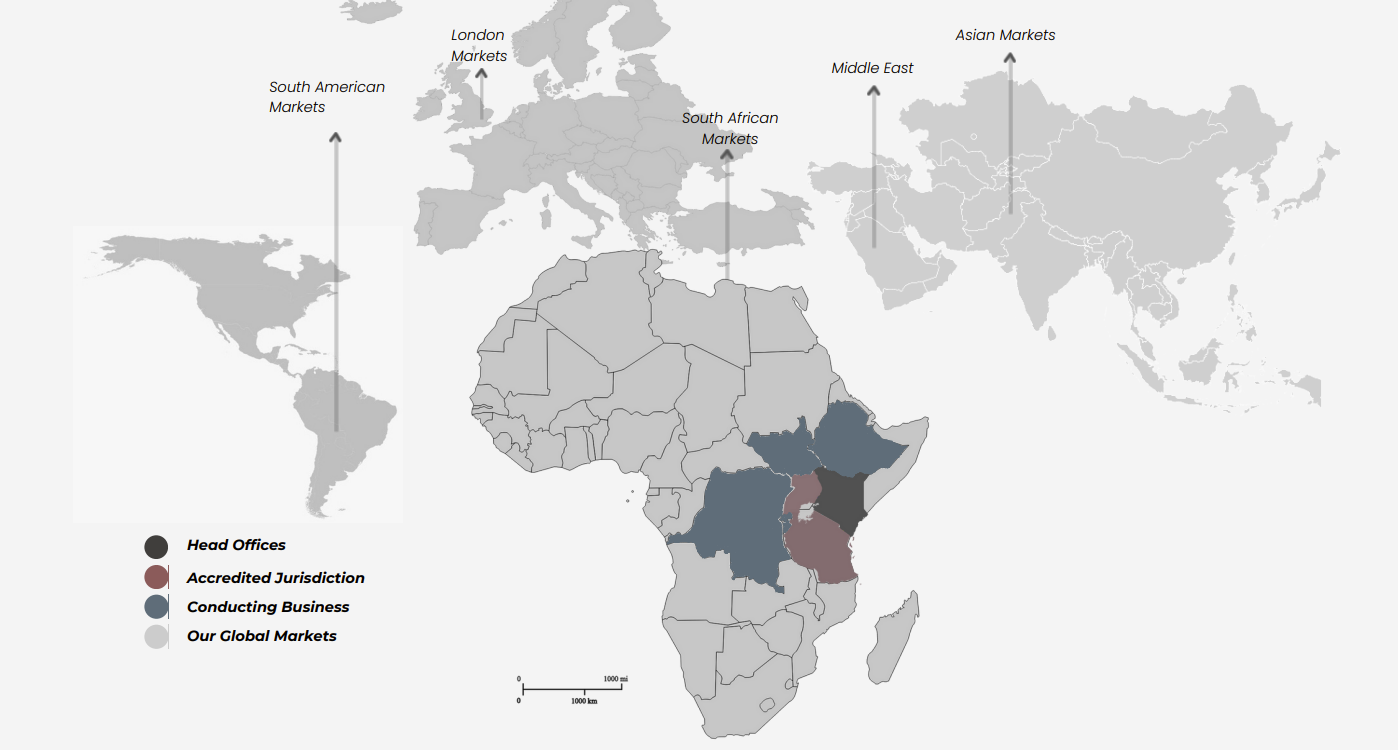

Our Presence and Markets

Why work with Acentria

At Acentria, we understand what’s on your mind. Our easy process takes care of your re-insurance needs, offering reliable coverage that gives you peace of mind. Let us handle your re-insurance worries at Acentria.

Innovation

We are Passionate about innovation because we believe its a driving force that fuels creativity, curiosity, and the pursuit of novel ideas and solutions

Data driven analytical capabilities

Our ability to use data, advanced analytics, and technology to extract valuable insights, help us to guide business to make informed decisions

Need Assistance with this cover ? Let Us Help!

Our focus is on building connections that guide you towards your next steps. This is achieved by truly understanding your needs and offering the best solution .

Let’s talk today!

Head office address:

Call Us:

(+254)731 200 999

Write to us:

support@acentriagroup.com