Reinsurance Consulting

Strategic insights to fortify your risk management

Our reinsurance consulting services offer strategic guidance and expertise to optimize your risk management and fortify your financial resilience.

Our team works with clients to design reinsurance structures that fit their risk management framework. This involves designing structures that target optimal volatility transfer, while ensuring cover is placed with reinsurers who have high credit standing.

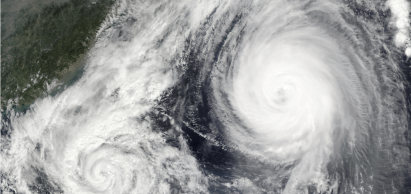

The team links reinsurance decisions financial performance, by looking at impact on Capital, Investment returns and operational efficiency. Through partnerships, the team delivers excellent analysis of exposure to natural catastrophes and guides on how the treaties can be set to achieve adequate protection.

Quality Services

Professional Services

Return on risk adjusted capital (RORAC)

Treaty analytics & optimization

Catastrophe modelling

Why work with Acentria

At Acentria Actuarial & Financial Services, we understand what’s on your mind. Our easy process takes care of your actuarial needs, offering reliable coverage that gives you peace of mind. Let us handle your actuarial worries at Acentria.

Innovation

We are Passionate about innovation because we believe its a driving force that fuels creativity, curiosity, and the pursuit of novel ideas and solutions

Data driven analytical capabilities

Our ability to use data, advanced analytics, and technology to extract valuable insights, help us to guide business to make informed decisions

Need Assistance with this service ? Let Us Help!

Our focus is on building connections that guide you towards your next steps. This is achieved by truly understanding your needs and offering the best solution .

Let’s talk today!

Head office address:

Call Us:

(+254)731 200 999

(+254)731 200 222

Write to us:

actuarial@acentriagroup.com